If you are a crypto investor, staying compliant with tax laws and regulations is important. Understanding how to report your crypto gains and losses on your taxes may seem overwhelming, but it is essential to be a responsible investor. To help you navigate this complex process, we have created a comprehensive crypto tax reporting guide with five manageable steps. Even in our previous blog, we have shared the bird’s view for Crypto reporting, and now, in the guide, we will delve deeper and answer all the questions around Crypto and Tax reporting!

First, let’s understand the type of crypto transactions. Are they all taxable?

How does the IRS categorize cryptocurrency?

The IRS 1040 Form Instructions clearly describe digital assets: cryptocurrencies and non-fungible tokens (NFTs). Digital assets are any digital representation of value that is recorded on a secure distributed ledger or similar technology. It is important to note that if an asset has the characteristics of a digital asset, it will be treated as such for federal income tax purposes. The IRS requires taxpayers to disclose digital asset transactions on Form 1040. If taxpayers have dealt with digital assets, they must check the “Yes” box on Form 1040 and file Form 8949, which tracks capital gains or losses. Report taxable cryptocurrency transactions to avoid a penalty for underreported taxes. Therefore, taxpayers must comply with the IRS regulations on digital assets.

Are crypto transactions taxable?

Not all crypto transactions are subject to taxes. You are exempt from paying taxes if you are involved in the following activities:

- Purchasing digital assets with cash

- Transferring digital assets between wallets or accounts that you own

- Gifting cryptocurrency (excluding large gifts that could trigger other tax obligations)

- Donating cryptocurrency, which is tax-deductible.

Which crypto transactions are subject to taxation?

The following activities related to cryptocurrency are considered taxable events:

- Selling digital assets in exchange for cash

- Trading one type of digital asset for another

- Using cryptocurrency as a form of payment

- Mining or staking cryptocurrency

- Receiving tokens through airdrops

- Getting paid in cryptocurrency

- Receiving interest or yield in cryptocurrency

Selling or using cryptocurrency as payment can result in a gain or loss, which must be reported on your tax return. Likewise, receiving cryptocurrency as income from mining, staking, airdrops, or payments for goods and services must also be reported, and the reported income determines your cost basis.

Now, let’s understand the step-by-step process.

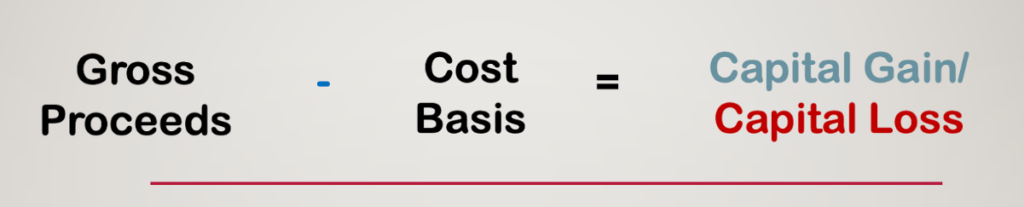

Step 1: Calculate Your Crypto Gains and Losses

It’s essential to understand your cryptocurrency gains and losses to ensure accurate tax reporting. Anytime you participate in a crypto transaction, such as selling, trading, swapping, or disposing of your crypto assets, you’ll trigger a taxable event. To calculate gains or losses from selling a digital asset, compare its value at the time of sale to the asset’s cost basis. Your cost basis refers to the cost of acquiring your cryptocurrency. It usually includes the fair market value of your crypto at the time of receipt and any fees related to the acquisition.

The IRS allows only two cost-basis assignment methods for cryptocurrency: FIFO and Specific Identification.

What is FIFO (first in, first out)?

First-In, First-Out (FIFO) assigns the cost basis of your crypto, where the oldest unit you acquired is sold or disposed of first.

What is Specific Identification?

Taxpayers have the option to use Specific Identification. By using this method, you can choose which cryptocurrency unit is disposed of during a transaction to minimize any gains or losses.

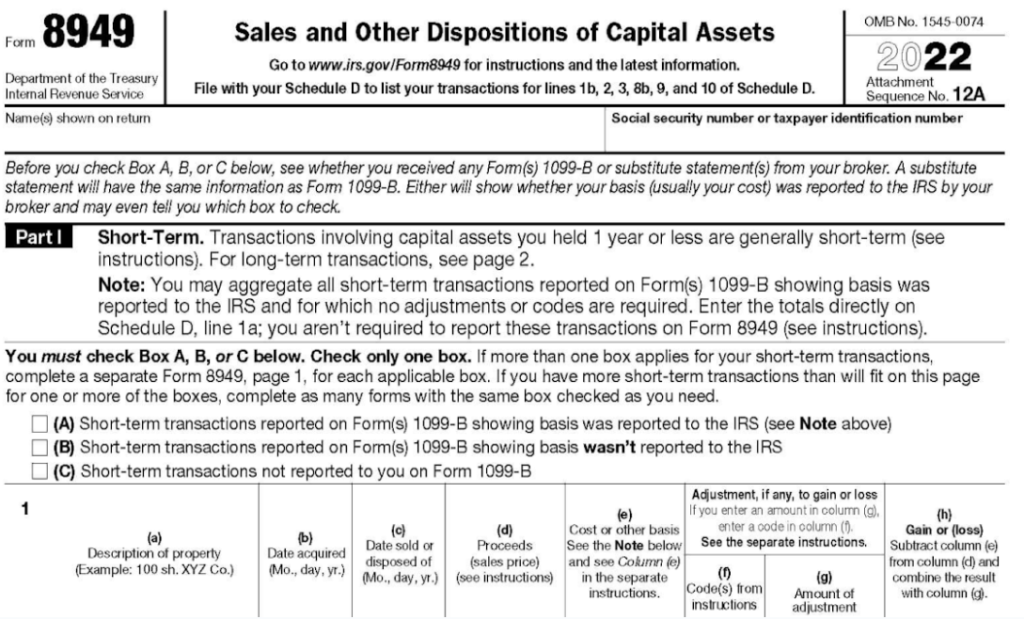

Step 2: Complete IRS Form 8949 for Crypto

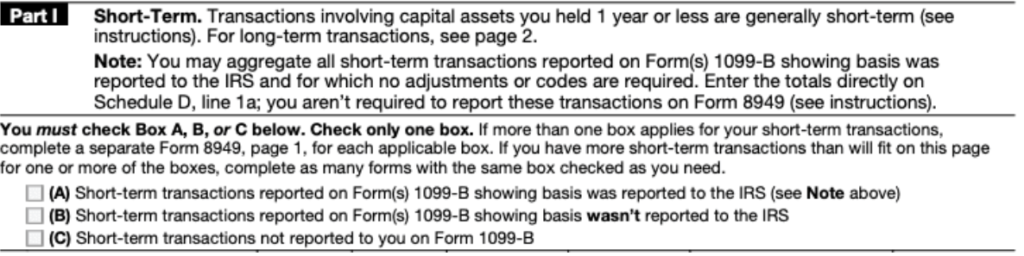

If you sell your cryptocurrency at any point during the tax year, you will be required to complete IRS Form 8949. This form is used to report the sales and disposals of capital assets, which include stocks, bonds, and cryptocurrencies. In order to fill out Form 8949, it’s important to understand the difference between short-term and long-term disposals.

If you sell your cryptocurrency after holding it for less than 12 months, you should report your gain or loss on Part I. On the other hand, if you sell your crypto after holding it for over 12 months, you should report your gain or loss on Part II.

Did you report your transaction on Form 1099? The first step is to check the relevant box at the top of the sheet: A, B, or C.

- Short-term transactions that have been reported on Form(s) 1099-B, showing that the basis was reported to the IRS.

- Short-term transactions that have been reported on Form(s) 1099-B, showing that the basis was not reported to the IRS.

- Short-term transactions that were not reported to you on Form 1099-B.

Currently, most exchanges do not issue Form 1099-B to customers and the IRS. Therefore, you will most likely select option C.

Here’s how you can report your gains and losses on Form 8949. You’ll need to fill in the following information for each gain and loss:

- A description of the cryptocurrency asset you sold (a)

- The date you originally acquired your cryptocurrency asset (b)

- The date you sold or disposed of the cryptocurrency asset (c)

- Proceeds from the sale; that is, the fair market value (d)

- Your cost basis for purchasing the cryptocurrency asset, which is also the fair market value (e)

- Your gain or loss (h)

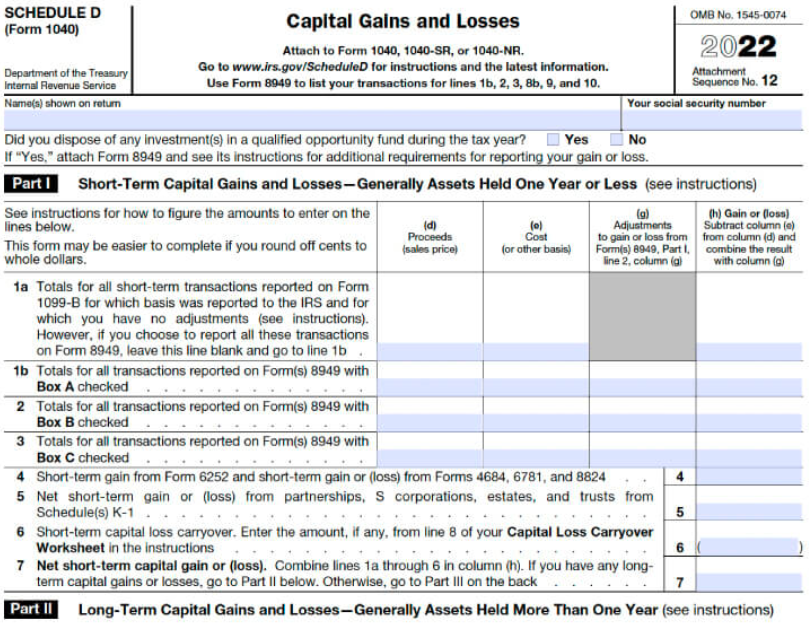

Step 3: Include Form 8949 with Form 1040 Schedule D

When dealing with your crypto-related financial activities, it’s important to remember that Form 8949 is not a standalone form. It should be included with Form 1040 Schedule D, where you report your overall capital gains and losses. Make sure to differentiate between short-term and long-term gains and losses, and document any losses to carry forward. This will provide a comprehensive view of your overall financial activities related to cryptocurrencies.

Step 4: Reporting Your Crypto Income

Crypto taxation extends beyond capital gains. Whether you’ve received, disposed of, or earned crypto through mining, staking, airdrops, hard forks, or lending interest, you must report it. Form 1040 Schedule 1 handles these instances, asking specific questions about your involvement with digital assets. Ordinary crypto income goes on line 8 under “Other income,” while self-employed individuals report on Form 1040 Schedule C.

Step 5: Complete Your Return

Once you have taken care of your crypto tax reporting, you can move on to completing the rest of your tax return. If you are self-employed, you might want to look into the deductions you can claim for expenses related to your crypto activities. Once you have everything in order, you will be able to file your taxes and fulfill your tax obligations without any further delay.

Mastering crypto tax reporting might seem intricate, but breaking it down into these five steps simplifies the process. By accurately calculating gains and losses, filling out the necessary forms, and understanding the nuances of crypto income reporting, you can confidently navigate the tax landscape. Remember, staying informed and organized is key to a stress-free tax season in the world of cryptocurrency.

Now, let’s dig into some considerations to take care of while filling up for Crypto!

What is the tax rate for crypto?

In the United States, there are two types of income: ordinary and capital gain. Capital gain income can be either long-term or short-term. If you receive cryptocurrency as payment for goods or services or through an airdrop, you will be taxed based on ordinary income tax rates. On the other hand, if you dispose of your cryptocurrency, the net gain or loss amount will be taxed as capital gains.

Short-term capital gains:

If you hold a particular cryptocurrency for less than one year, your transaction will be considered a short-term capital gain. Short-term capital gains are taxed at your ordinary income tax rate.

Long-term capital gains:

If you hold a cryptocurrency for more than a year, you qualify for tax-preferred, long-term capital gains taxed at 0%, 15%, or 20% based on your taxable income and filing status.

Income levels for each bracket change annually. Here’s a general breakdown:

- 0% capital gain rate for those in the 10% or 12% tax brackets.

- 15% capital gain rate for those in the 22%, 24%, or 32% tax brackets.

- 20% capital gain rate for those in the 35% and 37% income tax brackets.

How is crypto staking or mining taxed?

Staking rewards earned through ETH might be taxed as income based on the coins’ value at the time of receipt. As staked funds can’t be accessed until the network upgrade is complete, determining tax liabilities can be confusing. In the absence of IRS guidelines, taxable income could be deferred until funds are fully unlocked. Staking rewards for other cryptocurrencies and mining income on networks like Bitcoin are taxed as ordinary income.

How are crypto airdrops or hard forks taxed?

When you receive any cryptocurrency units through airdrops or hard forks, you must report them as regular income and pay taxes accordingly. Although both events can result in new coins, they are different from each other. An airdrop happens when new coins are deposited into your crypto wallet or exchange account, while a hard fork occurs when a single blockchain splits into two separate chains. If you are a holder of coins on the original chain, you may also receive new coins on the new, unique chain created after the hard fork.

How are crypto debit card payments taxed?

Using cryptocurrency for payments is a taxable event, including with a crypto payment card. If the price of your cryptocurrency is higher during purchase, you’ll be taxed for capital gains. But if you make purchases when your crypto assets are at a loss, you can offset capital gains through tax-loss harvesting.

How are crypto bankruptcies taxed?

In 2022, the crypto industry experienced market turbulence and bankruptcies, leaving users with inaccessible funds and uncertainty about their tax situation. If customers are not reimbursed in the bankruptcy, they may claim a tax deduction equal to their investment in the lost crypto less any payout received, which is treated as an ordinary loss.

How are crypto gifts and donations taxed?

The IRS treats cryptocurrency donations and gifts differently based on the recipient. Donating to an eligible charity is a charitable contribution while sending cryptocurrency to family, friends, or a medical campaign is considered a gift. Both gifting to a friend and donating to a charity are not taxable. Donating cryptocurrency may offer a tax benefit, depending on your situation. Learn more about crypto donations and gifts and their tax implications.

How are crypto-to-crypto transactions taxed?

It’s important to note that exchanging one cryptocurrency for another is considered a taxable event, regardless of whether it takes place on a centralized exchange or a DeFi exchange. For instance, if you exchange one cryptocurrency (let’s say 1 BTC) for another cryptocurrency (10 ETH), it will be considered a taxable disposal of 1 BTC at the fair market value of 10 ETH that you acquired in the transaction.

How are NFTs taxed?

Non-fungible tokens (NFTs) fall under the category of “digital assets” as defined by the IRS. Consequently, they are regarded as property and are therefore liable to be taxed as either capital gains or ordinary income. Moreover, certain NFTs may be considered “collectibles” by the IRS and hence may attract higher taxes than other capital assets. The NFT community is eagerly waiting for official guidance from the IRS to clarify whether they should be taxed as “collectables” or not.

How Nouvs Taxes can help?

Our team has years of expertise in US accounting and can help you with filing taxes for your Crypto investments. By strictly adhering to the issued guidelines and best practices, we can provide you with the necessary assistance for your financial success. Kindly give us a call or drop us a message at Krina@novustaxes.com, and one of our CPA experts will be happy to assist you.